FEATURED STORIES

The latest economic data is out and it is horrendous: with expectations for the ADP employment number to come at 175K, following a downward revised 177K print previously, it tumbled to a puny 38K in May. While this number is extremely irrelevant in terms of correlating to the actual NFP number due out this Friday, expect to see a spate of downward NFP revisions on this latest confirmation that the US economy has stalled even with QE2 still in effect for another 29 days (and soon to be extended). From the report: “Today’s ADP National Employment Report suggests that employment growth slowed sharply in May. Employment in the nonfarm private-business sector rose 38,000 from April to May on a seasonally adjusted basis. A deceleration in employment, while disappointing, is not entirely surprising. In the first quarter, GDP grew at only a 1.8% rate and only about 2¼% over the last four quarters. This is below most economists’ estimate of the economy’s potential growth rate and normally would be associated with very weak growth of employment.” Precisely as expected by Zero Hedge.

More:

May’s ADP Report estimates employment in the service-providing sector rose by 48,000, marking 17 consecutive months of employment gains while employment in the goods-producing sector fell 10,000 following six months of increases. Manufacturing employment fell 9,000 in May following seven consecutive monthly gains.

Employment among large businesses, defined as those with 500 or more workers, decreased by 19,000, while employment among medium-size businesses, defined as those with between 50 and 499 workers, increased by 30,000. Employment for small businesses, defined as those with fewer than 50 workers, rose 27,000 in May.

Employment in the construction industry dropped 8,000 in May, completely reversing April’s increase. The total decrease in construction employment since its peak in January 2007 is 2,124,000.

Also, so much for the financial and construction work renaissance:

Stock up with Fresh Food that lasts with eFoodsDirect (Ad)

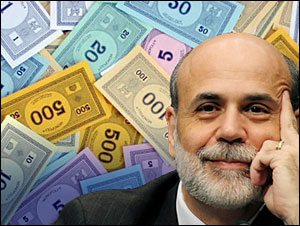

The only thing now preventing the Fed to begin the push for QE3 is the continuously resilient stock market, which needs to drop at least 15-20% before Bernanke is given a carte blanche. Yet paradoxically, it is stocks’ anticipation of QE 3 that makes the actual political case for QE 3 impossible. Geithner upcoming NYT op-ed: “Welcome To The Catch 22.”

Simon Maughn, co-head of European equities at MF Global, has told CNBC that a third round of so-called quantitative easing is in the works. The private Federal Reserve will again become the marginal buyer of bonds.

The latest effort by the Fed to finance the government’s staggering deficit will end in June.

If the private Federal Reserve owned by offshore banksters stops this lending scheme, interest rates will rise significantly which in turn will exert tremendous pressure on the American public. If interest rates surge anytime soon, millions of indebted Americans may default on their debt, thereby bankrupting the American financial institutions, as Puru Saxena, founder of Puru Saxena Wealth Management, notes.

“The bond market is going in one direction which is up-falling yields which is telling you quite clearly the direction of economic travel is downwards. Downgrades. QE3 (a third round of quantitative easing) is coming,” Maughn told the business news network. “The bond markets are all smarter than us, and that’s exactly what the bond markets are telling me.”

“What’s interesting in the bond markets over the last couple of sessions is, you’ve seen human traders trying to step in and call this turn in the market the same way that equities have done … and they have just been mowed down by the quant funds which are all about leverage, all about momentum and are betting on bond prices going up,” Maughn said.

“One more big injection of cash into the bond market should take you through at least the summer season into the beginning of the fourth quarter.”

“That cash injection will have the normal inflationary knock-on impact, driving back up commodities, supporting industrial stocks, dragging the financials up with them… I think it’s all about the monetary injection trade,” Maughn told CNBC.

Replies

Wall Street is having a hard time figuring out what to do now that the U.S. economy appears to be sputtering and yields are so low, Peter Yastrow, market strategist for Yastrow Origer, told CNBC.

"What we’ve got right now is almost near panic going on with money managers and people who are responsible for money," he said. "They can not find a yield and you just don’t want to be putting your money into commodities or things that are punts that might work out or they might not depending on what happens with the economy.

"We need to find real yield and real returns on these assets. You see bad data, you see Treasurys rally, you see all bonds and all fixed-income rally and then the people who are betting against the U.S. economy start getting bearish on stocks. That’s a huge mistake."

Stocks extended losses after the manufacturing fell below expectations in May and the private sector added only 38,000 jobs during the month.

"Interest rates are amazingly low and that, thanks to Ben Bernanke, is driving everything," Yastrow said. "We’re on the verge of a great, great depression. The [Federal Reserve] knows it.